THIS MATERIAL IS A MARKETING COMMUNICATION.

ESG Monthly (July 2021)

A brief commentary on environmental, social, governance news and developments globally and in key Asian markets in July 2021:

Globally…

- The European Commission announced a series of initiatives, including a new Sustainable Finance Strategy and sustainability reporting specifications under the EU Taxonomy, to promote a more sustainable financial system. (European Commission, July 2021)

- The European Commission launched a ‘Fit For 55’ legislative package that set out a roadmap to achieve its 55% emissions reduction target by 2030, and also plans to increase the amount of carbon emissions stored to 310 million tonnes by 2030. (European Commission, July 2021; Euractiv, July 2021)

The EU’s 13 ‘Fit for 55’ legislative packages

Source: European Commission, BofA Global Research, July 2021

- The United States put in place an executive order to enforce anticompetitive practices throughout the economy, with specific focus on healthcare, transportation, agriculture, technology and banks. (The White House, July 2021)

- G20 finance leaders recognized carbon pricing as a tool for carbon reduction to manage the impacts of climate change for the first time in an official communique. (Reuters, July 2021)

- The United Nations drafted a set of 21 proposals on biodiversity and conservation protection targets to be voted at the U.N. Convention on Biodiversity due to meet in October. (Reuters, July 2021)

- A group of global banks launched a pilot carbon exchange, Project Carbon, to provide liquidity, price discovery and transparency for carbon credit projects. (The Asset, July 2021)

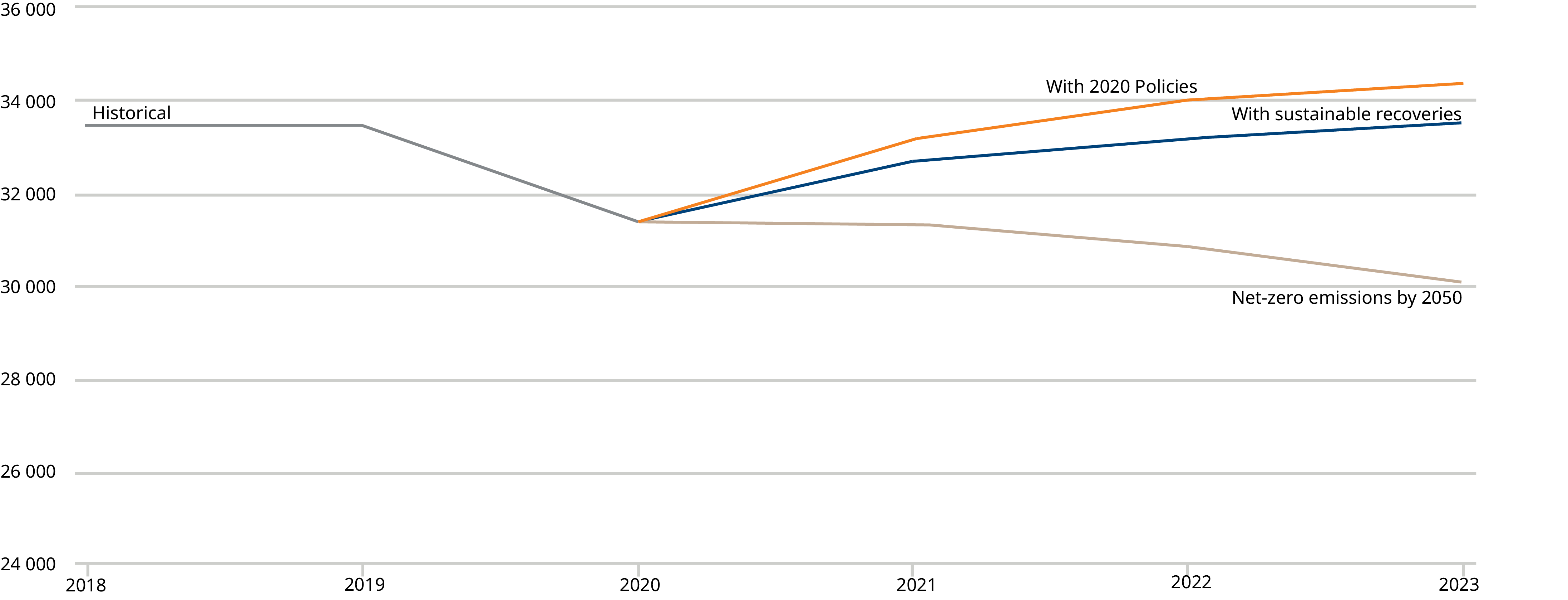

- A recent report from the International Energy Agency (IEA) highlighted that 2021 is on course for the second-largest yearly increase in history, with global carbon emission in 2023 likely to surge to a new record with “no clear peak in sight”. (IEA , July 2021) In addition, only 2% (US$380bn) of global fiscal support, directed to rebuilding economies amid and post the pandemic, went towards clean energy. (IEA , July 2021)

Energy-related carbon emissions under different trajectories up to 2023 (Mt CO2)

Source: IEA, July 2021

In key Asian markets…

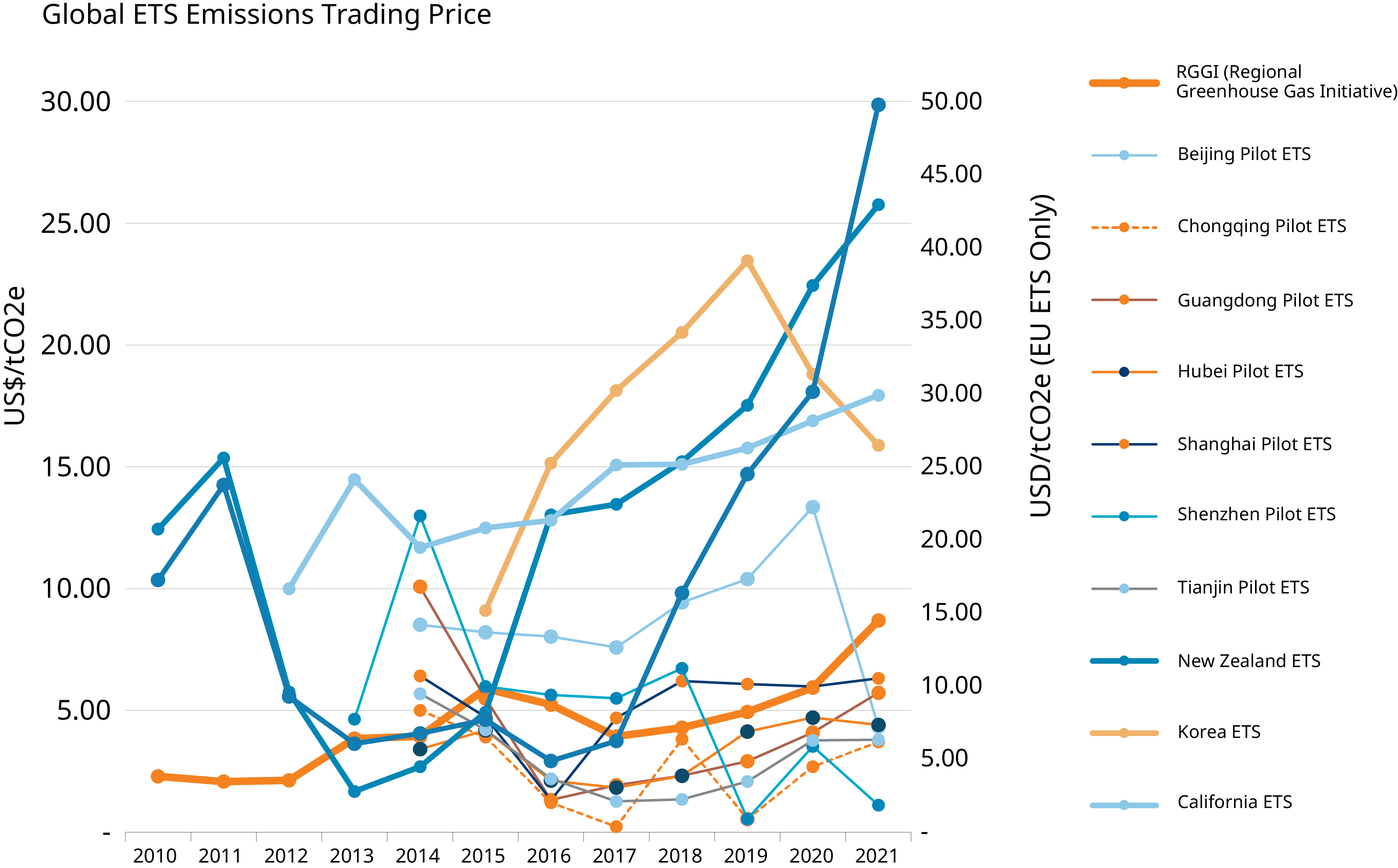

- In China, the national carbon training market was launched, covering more than 2,200 domestic Chinese power companies, responsible for around 40% of the carbon emissions. (UBS, July 2021) The carbon price closed on the first day at 51.23 RMB (USD7.92) per tonne. (UBS, July 2021)

Emissions trading prices at global emissions trading schemes (ETS)

Source: The World Bank, Morgan Stanley Research, July 2021 - In China, companies that contain personal information of more than 1 million users are subject to cybersecurity reviews by the Office of Cybersecurity Review before the firm is listed abroad. (Cyberspace Administration of China, July 2021)

- In South Korea, the government considers to resume operations of three nuclear power plants to ensure stable electricity supply during recent heat wave. (The Korea Times, July 2021) Efforts to limit power consumption included advising government ministries and other public institutions to refrain from using air conditioners in the afternoon. (The Korea Times, July 2021)

- A Carbon Tracker report finds China, India, Indonesia and Vietnam plan to build 600 new coal plants, which could account for 80% of the world’s planned new coal plants and 75% of existing coal capacity. (Carbon Tracker, July 2021)

Total Power from New Coal Project Planned

Source: Carbon Tracker, Mirae Asset analysis, July 2021

Read More on Mirae ESG

|

ESG Video: Introduction to ESG

Holly So, ESG Specialist, discusses what is ESG, why it’s important and what investors are doing around ESG. |

|

ESG Sector Review: Semiconductors & Hardware

A review on the semiconductor and hardware sector from an ESG perspective, highlighting key ESG issues as well as the road ahead for the sector in terms of ESG. |

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Copyright 2021. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.