THIS MATERIAL IS A MARKETING COMMUNICATION.

The Case for ESG Integration in Emerging Markets

Despite a traditionally higher risk profile, Emerging Market (EM) equities have proven resilient and shown relative strength following 2020’s 1st quarter volatility. Even more noteworthy is that EM companies that scored highly for environmental, social, and governance (ESG) metrics outperformed the broader market year-to-date. The MSCI Emerging Markets ESG Leaders Index, which tracks companies with high performance in ESG metrics relative to their peers, was up 4.56% versus -0.91% for the MSCI Emerging Markets Index year-to-date as of September 30, 2020. Over the last decade, the MSCI Emerging Markets ESG Leaders Index outperformed the broader MSCI Emerging Markets Index, with 6.30% annualized returns versus 2.87%, respectively, as of September 30, 2020. Interest in ESG issues is undoubtedly growing among investors, with ESG assets expected to reach $45 trillion by year-end.1

Navigating a Changing World

ESG considerations represent a vital part of active management, as the process leverages non-traditional criteria, both quantitative and qualitative, to enhance investment analysis and decision-making. ESG is a facet of the broader umbrella term Responsible Investing, which covers socially responsible Investing (SRI), ESG integration, Sustainable Investing, and Impact Investing. Compared to the rest of the Responsible investing universe, ESG integration goes beyond personal values. It takes a more holistic and forward-looking approach, understanding the changing world and the new factors that must be included to correctly value companies. Academic studies have shown that in today’s rapidly changing world, ignoring ESG may have financial consequences and that integrating ESG may be additive to long-term value creation.2 Today, more than 90% of the market value of the S&P 500 is attributable to intangible assets compared to only 17% in 1975.3 This change shows the need to expand the set of metrics necessary to value companies. Many of these expanded metrics fall within ESG factors.

While ESG factors continue to adapt to the changing world, the most relevant factors today and those that flow into Mirae Asset’s proprietary ESG scorecard are the following:

As ESG and impact investing become more mainstream, this is likely to encourage improvements in corporate standards globally, including in EM – where we see even greater scope for growth.

ESG in Emerging Markets

Despite the rising interest in ESG and Socially Responsible Investing, a large portion of ESG assets and the majority of inflows remain in developed markets.4 ESG risks are not necessarily higher in EM than in DM, as all companies face the same spectrum of ESG risks, but EM remains in the early stages of ESG integration due to an ESG data desert. The shortage of data has less to do with the lack of reporting and more to do with the global underweight in EM equities, leading to a lack of coverage which is perceived as a lack of data. As of September 30, 2020, EM accounted for approximately 12% of the global equity market, but global equity investors only held a 5% allocation to EM equities5.

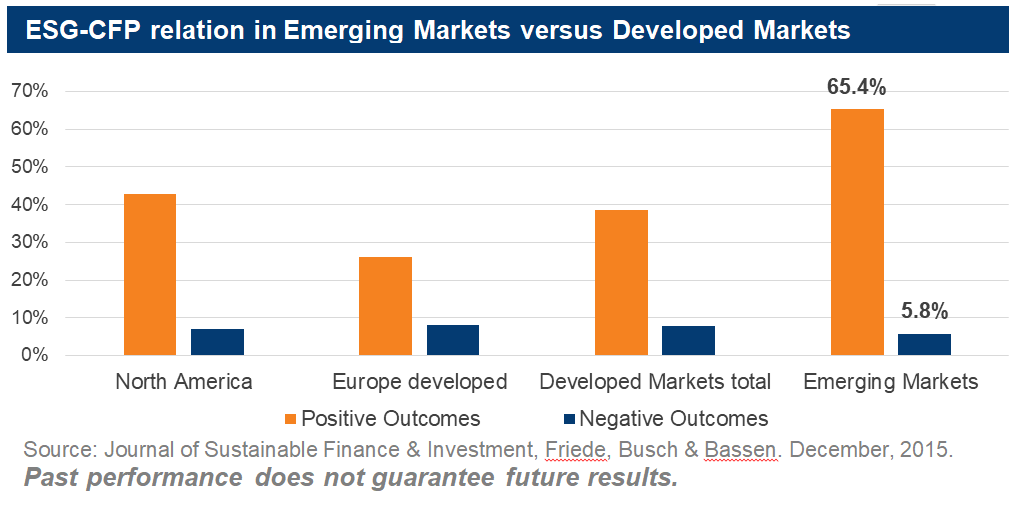

Given the complexities and relative information inefficiencies in the asset class, in-depth fundamental analysis that incorporates ESG consideration has shown to be helpful in accessing returns. Integrating ESG factors into an EM portfolio can produce even more robust results than in DM. An aggregated study of 402 equity-linked studies, looking at the relation of ESG and corporate financial performance (CFP), found that EM ESG portfolios showed a higher share of positive CFP outcomes over DM ESG portfolios.

Studies point to ESG investing having a particularly positive impact on returns in EM.6 Historically, companies in emerging markets were primarily focused on growth without considering pollution, land degradation, and certain labor rights. The development and maintenance of corporate social responsibility tend to rise in line with nations’ wealth. Therefore, as these markets grow in value, such standards should emerge, and an understanding of ESG is and will prove vital to EM investors.

Risk & Opportunities

ESG has come a long way over the last decade, evolving from a “feel good” investment strategy to being widely understood as a risk management tool and a potential source of alpha. The covid-19 crisis has shown the impact external non-financial risk can have on markets. Investments rooted in ESG criteria can help guard against exposure to these risks and uncover opportunities within an industry.

Environmental

- Risk: Many EM companies are particularly vulnerable to environmental factors, specifically climate change risks, given their geographic locations and the large share of gross domestic product (GDP) derived from natural resources. A majority of EM countries, including Brazil, Russia, India, and China, have fueled their economic expansion with carbon-based energy. Today, this type of growth has proven to have negative environmental impacts. China is leading EM countries by tackling this problem head-on.

- Opportunity: At the UN General Assembly on September 22, 2020, President Xi announced that China aims to achieve carbon neutrality before 2060. This is the first time that China has announced goals towards carbon neutrality. The expectation in the coming decades is for substantial transformation in China’s energy mix. It demonstrates that the Chinese government has begun to engage more on the social and environmental fronts. Other EM countries, such as Mexico, are using green financing to fuel sustainable economic growth. With government and financial backing as a tailwind, there is increasing potential for local renewable energy, water, and waste management companies to outperform.

Social

- Risk: Ignoring social issues can weaken a company’s competitive position and can also lead to boycotts, labor strikes, community hostility, and loss of licenses to operate, which can impact future earnings. Historically, emerging market companies have lagged on labor and human rights practices, which can affect a company’s profitability by increasing controversy exposure and creating a scarcity of skilled employees.

- Opportunity: The rise of a middle class in EM that is more aware and demanding of better labor practices, data privacy, health care, education, supply chains, and product quality can create opportunities for innovative companies that can adapt to sustainable consumer preferences. Income and wealth inequality are often considered significant issues within EM societies. There is an opportunity for companies that support inclusion and provide access for the disadvantaged. There is also opportunity for companies showing leadership in protecting their employees, suppliers, customers, and the communities they serve.

Governance

- Risk: A unique issue in many EMs is state -owned enterprises (SOEs), which represented 26% of the MSCI Emerging Market index as of December 31, 2019. SOEs are generally government-owned/influenced companies operating with a broader set of interests, appealing more to their political and socio-economic agendas rather than proper governance for minority shareholders. The significant presence of SOEs is a case where ESG integration can be advantageous, as SOEs often raise more flags than private firms when examining governance issues. Additionally, EM companies are particularly exposed to reputational risks that arise from corruption, bribery and sanctions. Reputation damage can have a material impact on share value.

- Opportunity: Improvements in corporate governance and transparency play a vital role in avoiding future controversies. Today, we see companies gradually positioning themselves as corporate citizens with a responsibility to the communities in which they operate. EM stock exchanges are promoting more sustainable behavior by introducing reporting standards, like in South Africa and Brazil, which also increases corporate transparency and accountability.

Mirae’s Approach to ESG

Mirae Asset recognizes that ESG issues have the potential to materially impact financial performance and therefore incorporates these considerations as a key step in our investment process. We view ESG factor analysis as a risk management tool to measure how well a company is positioned for sustainable long term growth. Given the ESG data inefficiencies in EM, as investors, we cannot rely on 3rd party stamp of approval. Instead, we integrate ESG factor analysis into our on-the-ground fundamental analysis. Rather than a screening tool, we use ESG analysis to help avoid unforeseen negative earnings revisions. As a part of our investment process, Mirae developed a proprietary ESG scorecard using the ESG factors previously mentioned, which is shared and maintained across investment teams for every company we cover. By monitoring progress on ESG issues, we can see a complete picture of the growth opportunities and risk exposure.

Shareholder engagement is another critical component to integrate ESG in EM equities effectively. We engage companies on ESG issues through proxy voting and one-on-one meetings with management, where we discuss material environmental and social issues and review corporate governance. In 2019, Mirae Asset exercised 100% of our voting rights. We vote for shareholder resolutions needed for business continuity and interests of minority shareholders.

Conclusion

As the world recovers from the 2020 health and economic crisis, investors need to ask themselves what types of investment approaches are likely to outperform in a post-Covid-19 market environment. ESG integration is one of the most significant developments in investing today, and long-term active fundamental investors, like Mirae, are well-positioned to harness this data to navigate today’s changing world.

1 JP Morgan. July, 2020.

2 Cambridge Associates. November, 2016.

3 Ocean Tomo. July, 2020

4 Morningstar. June, 2020.

5 Bloomberg & HSBC. September. 2020.

6 Cambridge Associates. November, 2016.

This material is neither an offer to sell nor solicitation to buy a security to any person in any jurisdiction where such solicitation, offer, purchase or sale would be unlawful under the laws of that jurisdiction. Investment involves risk.

The information in this material is based on sources we believe to be reliable but we do not guarantee the accuracy of completeness of the information provided. This material has not been reviewed by SFC and shall only be circulated in countries where it is permitted.

This material is intended solely for your private use and shall not be reproduced or recirculated either in whole or in part, without the written permission of Mirae Asset Global Investments. This document has been prepared for presentation, illustration and discussion purposes only and is not legally binding. Whilst compiled from sources Mirae Asset Global Investments believes to be accurate, no representation, warranty, assurance or implication to the accuracy, completeness or adequacy from defect of any kind is made. The division, group, subsidiary or affiliate of Mirae Asset Global Investments which produced this document shall not be liable to the recipient or controlling shareholders of the recipient resulting from its use. The views and information discussed or referred in this report are as of the date of publication, are subject to change and may not reflect the current views of the writer(s). The views expressed represent an assessment of market conditions at a specific point in time, are to be treated as opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. In addition, the opinions expressed are those of the writer(s) and may differ from those of other Mirae Asset Global Investments’ investment professionals.

The provision of this document shall not be deemed as constituting any offer, acceptance, or promise of any further contract or amendment to any contract which may exist between the parties. The issuer of this article is Mirae Asset Global Investments (HK) Limited (“we”) which we may or our managed funds may hold the mentioned securities. It should not be distributed to any other party except with the written consent of Mirae Asset Global Investments. Nothing herein contained shall be construed as granting the recipient whether directly or indirectly or by implication, any license or right, under any copy right or intellectual property rights to use the information herein. This document may include reference data from third-party sources and Mirae Asset Global Investments has not conducted any audit, validation, or verification of such data. Mirae Asset Global Investments accepts no liability for any loss or damage of any kind resulting out of the unauthorized use of this document. Investment involves risk. Past performance figures are not indicative of future performance. Forward-looking statements are not guarantees of performance. The information presented is not intended to provide specific investment advice. Please carefully read through the offering documents and seek independent professional advice before you make any investment decision. Products, services, and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries, and/or distributors of Mirae Asset Global Investments as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Hong Kong: This material is prepared by Mirae Asset Global Investments (HK) Limited (Mirae HK) and has not been reviewed by the HK SFC. Mirae HK is regulated by the SFC (CE reference: ALK083).

Australia: The information contained on this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempt from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. By accessing this document and any information or content contained in it, you represent that you are a ‘wholesale client’ under the Corporations Act. This document is strictly for information purposes only and does not constitute a representation that any investment strategy is suitable or appropriate for an investor’s individual circumstances. Further, this document should not be regarded by investors as a substitute for independent professional advice or the exercise of their own judgement. The contents of this document is prepared and maintained by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of MAGI HK.

Copyright 2020. All rights reserved.

The Case for ESG Integration in Emerging Markets

Despite a traditionally higher risk profile, Emerging Market (EM) equities have proven resilient and shown relative strength following 2020’s 1st quarter volatility. Even more noteworthy is that EM companies that scored highly for environmental, social, and governance (ESG) metrics outperformed the broader market year-to-date. The MSCI Emerging Markets ESG Leaders Index, which tracks companies with high performance in ESG metrics relative to their peers, was up 4.56% versus -0.91% for the MSCI Emerging Markets Index year-to-date as of September 30, 2020. Over the last decade, the MSCI Emerging Markets ESG Leaders Index outperformed the broader MSCI Emerging Markets Index, with 6.30% annualized returns versus 2.87%, respectively, as of September 30, 2020. Interest in ESG issues is undoubtedly growing among investors, with ESG assets expected to reach $45 trillion by year-end.1

Navigating a Changing World

ESG considerations represent a vital part of active management, as the process leverages non-traditional criteria, both quantitative and qualitative, to enhance investment analysis and decision-making. ESG is a facet of the broader umbrella term Responsible Investing, which covers socially responsible Investing (SRI), ESG integration, Sustainable Investing, and Impact Investing. Compared to the rest of the Responsible investing universe, ESG integration goes beyond personal values. It takes a more holistic and forward-looking approach, understanding the changing world and the new factors that must be included to correctly value companies. Academic studies have shown that in today’s rapidly changing world, ignoring ESG may have financial consequences and that integrating ESG may be additive to long-term value creation.2 Today, more than 90% of the market value of the S&P 500 is attributable to intangible assets compared to only 17% in 1975.3 This change shows the need to expand the set of metrics necessary to value companies. Many of these expanded metrics fall within ESG factors.

While ESG factors continue to adapt to the changing world, the most relevant factors today and those that flow into Mirae Asset’s proprietary ESG scorecard are the following:

As ESG and impact investing become more mainstream, this is likely to encourage improvements in corporate standards globally, including in EM – where we see even greater scope for growth.

ESG in Emerging Markets

Despite the rising interest in ESG and Socially Responsible Investing, a large portion of ESG assets and the majority of inflows remain in developed markets.4 ESG risks are not necessarily higher in EM than in DM, as all companies face the same spectrum of ESG risks, but EM remains in the early stages of ESG integration due to an ESG data desert. The shortage of data has less to do with the lack of reporting and more to do with the global underweight in EM equities, leading to a lack of coverage which is perceived as a lack of data. As of September 30, 2020, EM accounted for approximately 12% of the global equity market, but global equity investors only held a 5% allocation to EM equities5.

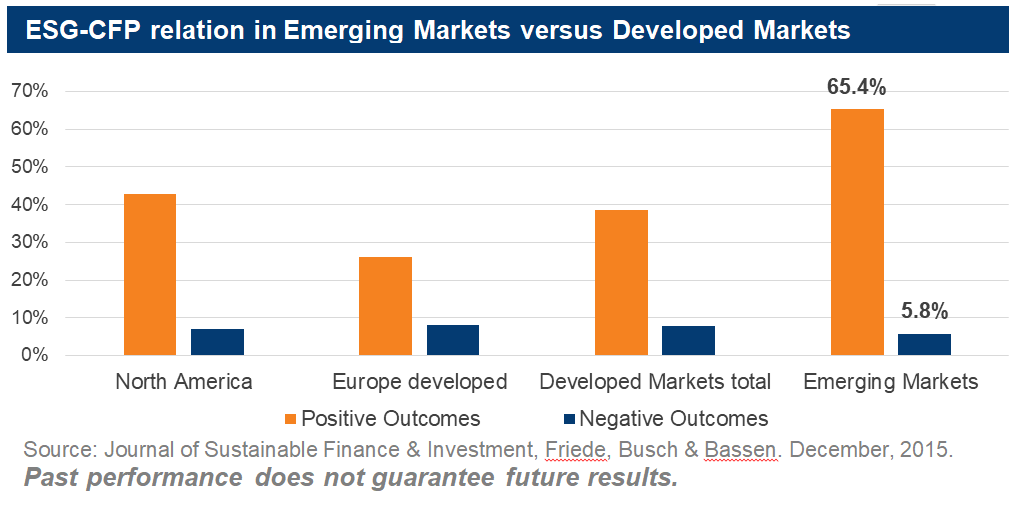

Given the complexities and relative information inefficiencies in the asset class, in-depth fundamental analysis that incorporates ESG consideration has shown to be helpful in accessing returns. Integrating ESG factors into an EM portfolio can produce even more robust results than in DM. An aggregated study of 402 equity-linked studies, looking at the relation of ESG and corporate financial performance (CFP), found that EM ESG portfolios showed a higher share of positive CFP outcomes over DM ESG portfolios.

Studies point to ESG investing having a particularly positive impact on returns in EM.6 Historically, companies in emerging markets were primarily focused on growth without considering pollution, land degradation, and certain labor rights. The development and maintenance of corporate social responsibility tend to rise in line with nations’ wealth. Therefore, as these markets grow in value, such standards should emerge, and an understanding of ESG is and will prove vital to EM investors.

Risk & Opportunities

ESG has come a long way over the last decade, evolving from a “feel good” investment strategy to being widely understood as a risk management tool and a potential source of alpha. The covid-19 crisis has shown the impact external non-financial risk can have on markets. Investments rooted in ESG criteria can help guard against exposure to these risks and uncover opportunities within an industry.

Environmental

- Risk: Many EM companies are particularly vulnerable to environmental factors, specifically climate change risks, given their geographic locations and the large share of gross domestic product (GDP) derived from natural resources. A majority of EM countries, including Brazil, Russia, India, and China, have fueled their economic expansion with carbon-based energy. Today, this type of growth has proven to have negative environmental impacts. China is leading EM countries by tackling this problem head-on.

- Opportunity: At the UN General Assembly on September 22, 2020, President Xi announced that China aims to achieve carbon neutrality before 2060. This is the first time that China has announced goals towards carbon neutrality. The expectation in the coming decades is for substantial transformation in China’s energy mix. It demonstrates that the Chinese government has begun to engage more on the social and environmental fronts. Other EM countries, such as Mexico, are using green financing to fuel sustainable economic growth. With government and financial backing as a tailwind, there is increasing potential for local renewable energy, water, and waste management companies to outperform.

Social

- Risk: Ignoring social issues can weaken a company’s competitive position and can also lead to boycotts, labor strikes, community hostility, and loss of licenses to operate, which can impact future earnings. Historically, emerging market companies have lagged on labor and human rights practices, which can affect a company’s profitability by increasing controversy exposure and creating a scarcity of skilled employees.

- Opportunity: The rise of a middle class in EM that is more aware and demanding of better labor practices, data privacy, health care, education, supply chains, and product quality can create opportunities for innovative companies that can adapt to sustainable consumer preferences. Income and wealth inequality are often considered significant issues within EM societies. There is an opportunity for companies that support inclusion and provide access for the disadvantaged. There is also opportunity for companies showing leadership in protecting their employees, suppliers, customers, and the communities they serve.

Governance

- Risk: A unique issue in many EMs is state -owned enterprises (SOEs), which represented 26% of the MSCI Emerging Market index as of December 31, 2019. SOEs are generally government-owned/influenced companies operating with a broader set of interests, appealing more to their political and socio-economic agendas rather than proper governance for minority shareholders. The significant presence of SOEs is a case where ESG integration can be advantageous, as SOEs often raise more flags than private firms when examining governance issues. Additionally, EM companies are particularly exposed to reputational risks that arise from corruption, bribery and sanctions. Reputation damage can have a material impact on share value.

- Opportunity: Improvements in corporate governance and transparency play a vital role in avoiding future controversies. Today, we see companies gradually positioning themselves as corporate citizens with a responsibility to the communities in which they operate. EM stock exchanges are promoting more sustainable behavior by introducing reporting standards, like in South Africa and Brazil, which also increases corporate transparency and accountability.

Mirae’s Approach to ESG

Mirae Asset recognizes that ESG issues have the potential to materially impact financial performance and therefore incorporates these considerations as a key step in our investment process. We view ESG factor analysis as a risk management tool to measure how well a company is positioned for sustainable long term growth. Given the ESG data inefficiencies in EM, as investors, we cannot rely on 3rd party stamp of approval. Instead, we integrate ESG factor analysis into our on-the-ground fundamental analysis. Rather than a screening tool, we use ESG analysis to help avoid unforeseen negative earnings revisions. As a part of our investment process, Mirae developed a proprietary ESG scorecard using the ESG factors previously mentioned, which is shared and maintained across investment teams for every company we cover. By monitoring progress on ESG issues, we can see a complete picture of the growth opportunities and risk exposure.

Shareholder engagement is another critical component to integrate ESG in EM equities effectively. We engage companies on ESG issues through proxy voting and one-on-one meetings with management, where we discuss material environmental and social issues and review corporate governance. In 2019, Mirae Asset exercised 100% of our voting rights. We vote for shareholder resolutions needed for business continuity and interests of minority shareholders.

Conclusion

As the world recovers from the 2020 health and economic crisis, investors need to ask themselves what types of investment approaches are likely to outperform in a post-Covid-19 market environment. ESG integration is one of the most significant developments in investing today, and long-term active fundamental investors, like Mirae, are well-positioned to harness this data to navigate today’s changing world.

1 JP Morgan. July, 2020.

2 Cambridge Associates. November, 2016.

3 Ocean Tomo. July, 2020

4 Morningstar. June, 2020.

5 Bloomberg & HSBC. September. 2020.

6 Cambridge Associates. November, 2016.

This material is neither an offer to sell nor solicitation to buy a security to any person in any jurisdiction where such solicitation, offer, purchase or sale would be unlawful under the laws of that jurisdiction. Investment involves risk.

The information in this material is based on sources we believe to be reliable but we do not guarantee the accuracy of completeness of the information provided. This material has not been reviewed by SFC and shall only be circulated in countries where it is permitted.

This material is intended solely for your private use and shall not be reproduced or recirculated either in whole or in part, without the written permission of Mirae Asset Global Investments. This document has been prepared for presentation, illustration and discussion purposes only and is not legally binding. Whilst compiled from sources Mirae Asset Global Investments believes to be accurate, no representation, warranty, assurance or implication to the accuracy, completeness or adequacy from defect of any kind is made. The division, group, subsidiary or affiliate of Mirae Asset Global Investments which produced this document shall not be liable to the recipient or controlling shareholders of the recipient resulting from its use. The views and information discussed or referred in this report are as of the date of publication, are subject to change and may not reflect the current views of the writer(s). The views expressed represent an assessment of market conditions at a specific point in time, are to be treated as opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. In addition, the opinions expressed are those of the writer(s) and may differ from those of other Mirae Asset Global Investments’ investment professionals.

The provision of this document shall not be deemed as constituting any offer, acceptance, or promise of any further contract or amendment to any contract which may exist between the parties. The issuer of this article is Mirae Asset Global Investments (HK) Limited (“we”) which we may or our managed funds may hold the mentioned securities. It should not be distributed to any other party except with the written consent of Mirae Asset Global Investments. Nothing herein contained shall be construed as granting the recipient whether directly or indirectly or by implication, any license or right, under any copy right or intellectual property rights to use the information herein. This document may include reference data from third-party sources and Mirae Asset Global Investments has not conducted any audit, validation, or verification of such data. Mirae Asset Global Investments accepts no liability for any loss or damage of any kind resulting out of the unauthorized use of this document. Investment involves risk. Past performance figures are not indicative of future performance. Forward-looking statements are not guarantees of performance. The information presented is not intended to provide specific investment advice. Please carefully read through the offering documents and seek independent professional advice before you make any investment decision. Products, services, and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries, and/or distributors of Mirae Asset Global Investments as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction.

Hong Kong: This material is prepared by Mirae Asset Global Investments (HK) Limited (Mirae HK) and has not been reviewed by the HK SFC. Mirae HK is regulated by the SFC (CE reference: ALK083).

Australia: The information contained on this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempt from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. By accessing this document and any information or content contained in it, you represent that you are a ‘wholesale client’ under the Corporations Act. This document is strictly for information purposes only and does not constitute a representation that any investment strategy is suitable or appropriate for an investor’s individual circumstances. Further, this document should not be regarded by investors as a substitute for independent professional advice or the exercise of their own judgement. The contents of this document is prepared and maintained by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission. No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission of MAGI HK.

Copyright 2020. All rights reserved.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Copyright 2021. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.