THIS MATERIAL IS A MARKETING COMMUNICATION.

China Robotics Industry Gears Up for Growth

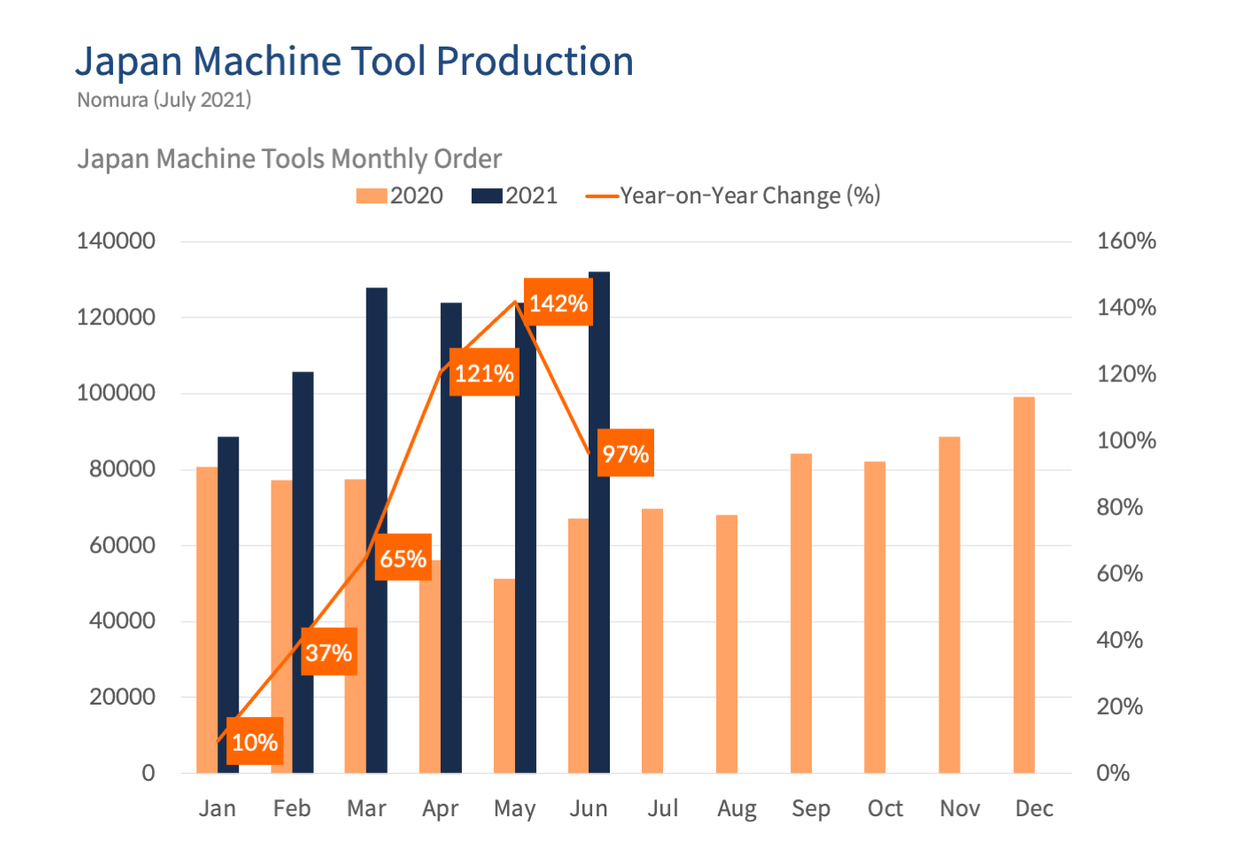

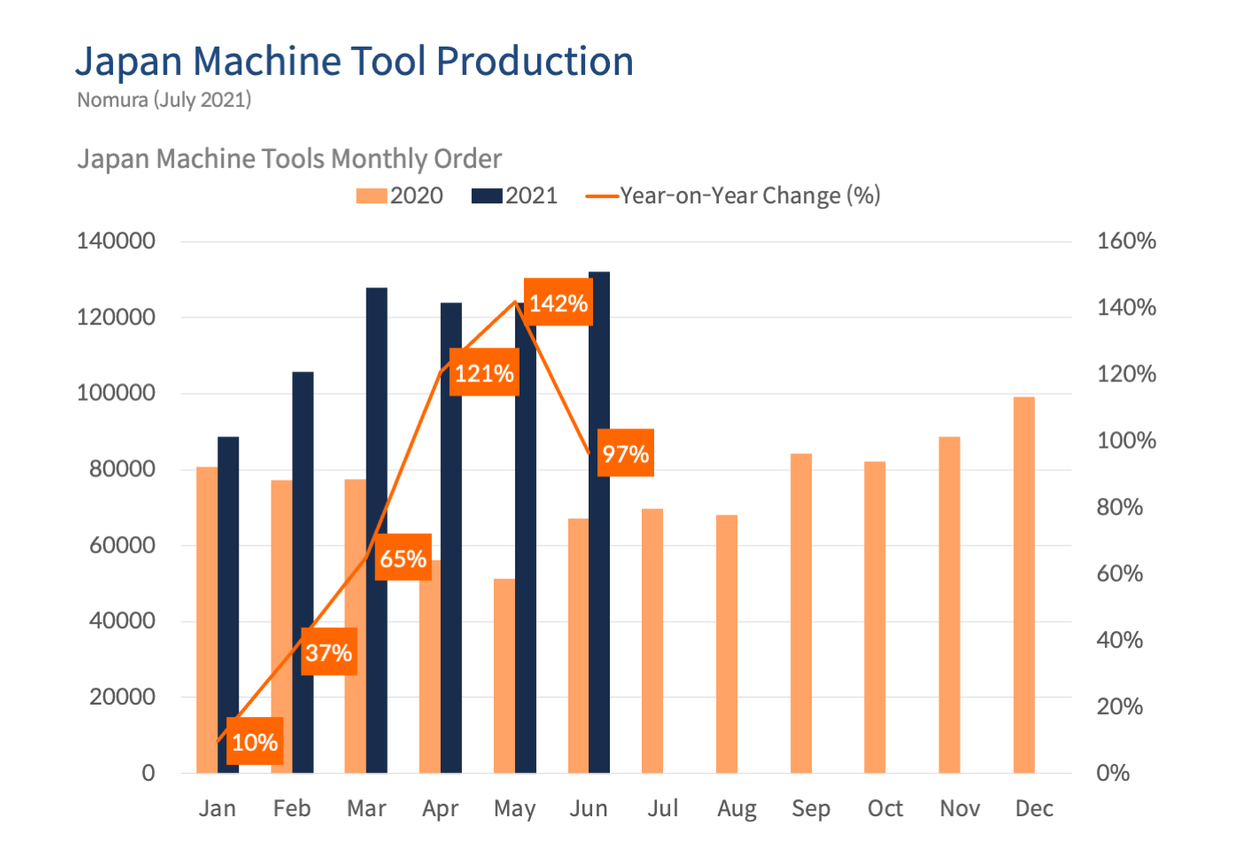

The China robotics industry upcycle – which we saw in the first half of 2021 – has yet to peak. Fast-growing industries in electric vehicles (EVs), batteries, solar and semiconductors drove demand for automated robotic manufacturing, which saw high first-quarter year-on-year (YoY) growth against a low base in 2020. Second-quarter YoY growth was also solid, despite a higher base in 2020 from the production of face masks in response to the global pandemic. The growth we’ve seen is unlikely to run into the remainder of the year, though likely to remain positive and go into double digits.

Rising costs of raw materials and the sustainability of automation cycles were a cause of concern over the first half of the year. The former was managed through price increases, improved supply chain management and moving forward purchase dates for raw materials and components. The latter has yet to fully play out, and we’ll be following these developments closely for the remainder of the year.

Growth in robotics and automation over the first half of 2021 was a stark contrast against the challenges the industry faced over the same period last year, where a labour shortage due to COVID-19 impacted many manufacturing processes and global supply chains. In many ways, the coronavirus outbreak accelerated the adoption of digitisation and more automation into manufacturing processes, particularly for those fast-growing and new infrastructure industries.

Those companies in traditional sectors such as heavy machinery, textiles and automotive original equipment manufacturers (OEMs) – where components are produced in-house – also quickly adapted supply chains and incorporated more automation to counter labour supply disruption during COVID-19 to improve cost competitiveness, and address concerns over rising labour costs in China.

Circuit Training

China has long been planning its own “robotics revolution” to sever the country’s reliance on foreign technology. As one of the focal points of the “Made in China 2025” campaign, China is encouraging Chinese companies to consider domestic research and development into manufacturing, that aims to ultimately house an industrial robot population of 1.8 million by 2025. Against this backdrop, we’ve seen several young, home-grown companies rise as worthy competitors on the international stage.

With China as one of the world’s largest robotics manufacturers, domestic companies are primed to compete against international robotics giants, in our view. Younger Chinese robotics companies often find themselves in a challenging environment. The industry is often filled with large, international competitors with more experience in application and automation.

However, younger robotics players can offer cost-competitive products, strong servicing capabilities and are often more nimble to scale operations to meet a rising demand for robotics equipment in China – and close the gap between Chinese-owned and international players.

China Robotics Industry Gears Up for Growth

The China robotics industry upcycle – which we saw in the first half of 2021 – has yet to peak. Fast-growing industries in electric vehicles (EVs), batteries, solar and semiconductors drove demand for automated robotic manufacturing, which saw high first-quarter year-on-year (YoY) growth against a low base in 2020. Second-quarter YoY growth was also solid, despite a higher base in 2020 from the production of face masks in response to the global pandemic. The growth we’ve seen is unlikely to run into the remainder of the year, though likely to remain positive and go into double digits.

Rising costs of raw materials and the sustainability of automation cycles were a cause of concern over the first half of the year. The former was managed through price increases, improved supply chain management and moving forward purchase dates for raw materials and components. The latter has yet to fully play out, and we’ll be following these developments closely for the remainder of the year.

Growth in robotics and automation over the first half of 2021 was a stark contrast against the challenges the industry faced over the same period last year, where a labour shortage due to COVID-19 impacted many manufacturing processes and global supply chains. In many ways, the coronavirus outbreak accelerated the adoption of digitisation and more automation into manufacturing processes, particularly for those fast-growing and new infrastructure industries.

Those companies in traditional sectors such as heavy machinery, textiles and automotive original equipment manufacturers (OEMs) – where components are produced in-house – also quickly adapted supply chains and incorporated more automation to counter labour supply disruption during COVID-19 to improve cost competitiveness, and address concerns over rising labour costs in China.

Circuit Training

China has long been planning its own “robotics revolution” to sever the country’s reliance on foreign technology. As one of the focal points of the “Made in China 2025” campaign, China is encouraging Chinese companies to consider domestic research and development into manufacturing, that aims to ultimately house an industrial robot population of 1.8 million by 2025. Against this backdrop, we’ve seen several young, home-grown companies rise as worthy competitors on the international stage.

With China as one of the world’s largest robotics manufacturers, domestic companies are primed to compete against international robotics giants, in our view. Younger Chinese robotics companies often find themselves in a challenging environment. The industry is often filled with large, international competitors with more experience in application and automation.

However, younger robotics players can offer cost-competitive products, strong servicing capabilities and are often more nimble to scale operations to meet a rising demand for robotics equipment in China – and close the gap between Chinese-owned and international players.

Disclaimer & Information for Investors

No distribution, solicitation or advice: This document is provided for information and illustrative purposes and is intended for your use only. It is not a solicitation, offer or recommendation to buy or sell any security or other financial instrument. The information contained in this document has been provided as a general market commentary only and does not constitute any form of regulated financial advice, legal, tax or other regulated service.

The views and information discussed or referred in this document are as of the date of publication. Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. Views, opinions and estimates may change without notice and are based on a number of assumptions which may or may not eventuate or prove to be accurate. Actual results, performance or events may differ materially from those in such statements. In addition, the opinions expressed may differ from those of other Mirae Asset Global Investments’ investment professionals.

Investment involves risk: Past performance is not indicative of future performance. It cannot be guaranteed that the performance of the Fund will generate a return and there may be circumstances where no return is generated or the amount invested is lost. It may not be suitable for persons unfamiliar with the underlying securities or who are unwilling or unable to bear the risk of loss and ownership of such investment. Before making any investment decision, investors should read the Prospectus for details and the risk factors. Investors should ensure they fully understand the risks associated with the Fund and should also consider their own investment objective and risk tolerance level. Investors are advised to seek independent professional advice before making any investment.

Sources: Information and opinions presented in this document have been obtained or derived from sources which in the opinion of Mirae Asset Global Investments (“MAGI”) are reliable, but we make no representation as to their accuracy or completeness. We accept no liability for a loss arising from the use of this document.

Products, services and information may not be available in your jurisdiction and may be offered by affiliates, subsidiaries and/or distributors of MAGI as stipulated by local laws and regulations. Please consult with your professional adviser for further information on the availability of products and services within your jurisdiction. This document is issued by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Securities and Futures Commission.

Information for EU investors pursuant to Regulation (EU) 2019/1156: This document is a marketing communication and is intended for Professional Investors only. A Prospectus is available for the Mirae Asset Global Discovery Fund (the “Company”) a société d'investissement à capital variable (SICAV) domiciled in Luxembourg structured as an umbrella with a number of sub-funds. Key Investor Information Documents (“KIIDs”) are available for each share class of each of the sub-funds of the Company.

The Company’s Prospectus and the KIIDs can be obtained from www.am.miraeasset.eu/fund-literature . The Prospectus is available in English, French, German, and Danish, while the KIIDs are available in one of the official languages of each of the EU Member States into which each sub-fund has been notified for marketing under the Directive 2009/65/EC (the “UCITS Directive”). Please refer to the Prospectus and the KIID before making any final investment decisions.

A summary of investor rights is available in English from www.am.miraeasset.eu/investor-rights-summary.

The sub-funds of the Company are currently notified for marketing into a number of EU Member States under the UCITS Directive. FundRock Management Company can terminate such notifications for any share class and/or sub-fund of the Company at any time using the process contained in Article 93a of the UCITS Directive.

Australia: The information contained in this document is provided by Mirae Asset Global Investments (HK) Limited (“MAGIHK”), which is exempted from the requirement to hold an Australian financial services license under the Corporations Act 2001 (Cth) (Corporations Act) pursuant to ASIC Class Order 03/1103 (Class Order) in respect of the financial services it provides to wholesale clients (as defined in the Corporations Act) in Australia. MAGIHK is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which differ from Australian laws. Pursuant to the Class Order, this document and any information regarding MAGIHK and its products is strictly provided to and intended for Australian wholesale clients only. The contents of this document is prepared by Mirae Asset Global Investments (HK) Limited and has not been reviewed by the Australian Investments & Securities Commission.

Copyright 2021. All rights reserved. No part of this document may be reproduced in any form, or referred to in any other publication, without express written permission of Mirae Asset Global Investments (Hong Kong) Limited.